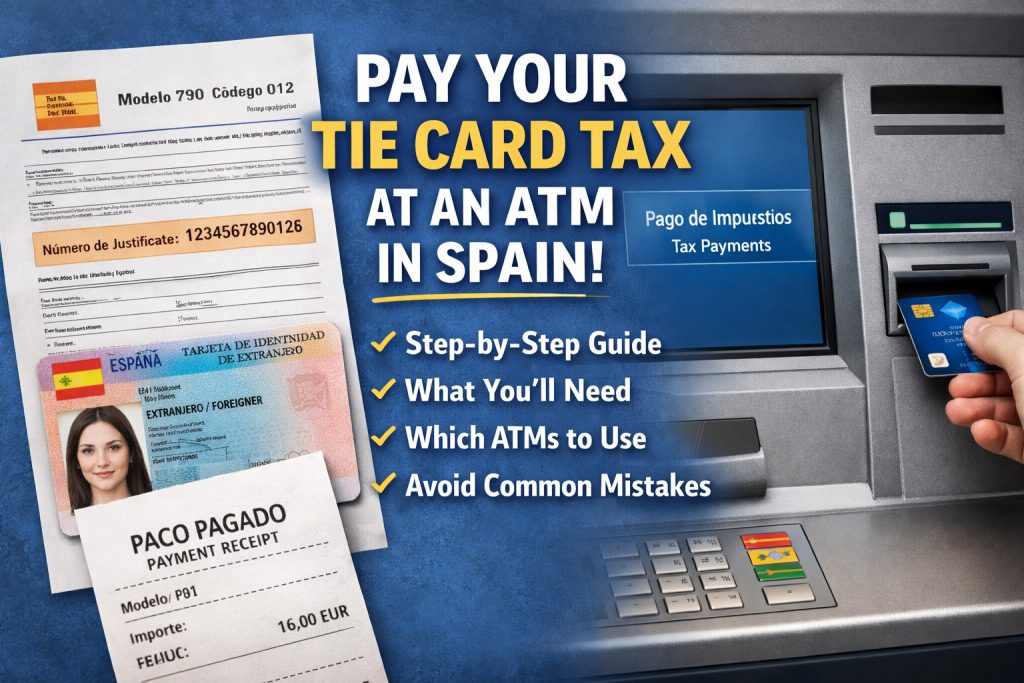

If you’re applying for or renewing a TIE (Tarjeta de Identidad de Extranjero) in Spain, you must first pay the required administrative tax (modelo 790, código 012) before attending your police appointment. One convenient way many people pay this tax is directly at a Spanish ATM using a credit or debit card.

This guide explains how it works, what machines accept payments, step-by-step instructions, and tips to avoid mistakes— so you can pay your TIE tax with confidence.

📌 What You Need Before You Start

Before paying at an ATM, make sure you have:

- ☑️ Your tax payment form (Modelo 790, Código 012) printed.

- ☑️ The reference number on that form (a long number next to “Número de justificante”).

- ☑️ A Spanish bank card (debit or credit) that works in ATMs (Visa or Mastercard).

- ☑️ Enough balance in your card to cover the tax amount + any ATM fees.

👉 TIP: ATMs inside or outside bank branches usually have lower fees than independent cash machines.

🇪🇸 Where You Can Pay the TIE Tax by ATM

In Spain, not all ATMs allow administrative tax payments. The most commonly working ones are:

- 🏦 La Caixa / CaixaBank ATMs

- 🏦 Bankia / CaixaBank group ATMs

- 🏦 Some BBVA and Santander machines (less common)

If the ATM screen doesn’t show a “Pago de impuestos / Taxes” or “Administración Pública” option — it’s likely not supported.

🧾 Step-by-Step: Paying TIE Tax at an ATM

Follow these exact steps:

- Insert your bank card into a Spanish ATM and enter your PIN.

- On the main menu, choose “Pagos / Payments.”

- Look for “Impuestos / Tax Payments” or “Administración Pública / Public Administration.”

- Select “Pagar impuestos con referencia” (Pay taxes with reference).

- Enter the reference number from your Modelo 790 form carefully.

- Confirm the tax amount displayed on screen.

- Choose pay with debit or credit card.

- Confirm the transaction and wait for the receipt to print.

- Keep the ATM receipt — it’s your official tax payment proof.

✅ IMPORTANT: The ATM receipt must show the reference number and the amount paid clearly. Always keep this for your immigration appointment.

🧠 Common Questions & Mistakes

❓ Can I Pay With a Foreign Card?

Yes — most Spanish ATMs accept international Visa and Mastercard cards, but:

- Some banks may block the transaction for security.

- Your home bank might charge FX fees or ATM service fees.

👉 If payment fails, try another bank’s ATM.

❓ Can I Pay After Hours?

Yes — ATMs work 24/7. Choose machines at bank branches for less risk of card blocking and better support if something goes wrong.

❓ What If the Payment Fails?

If the ATM doesn’t complete the payment:

- Do not attempt the same reference number too many times — it can block your card.

- Try another ATM brand (e.g., switch from BBVA to CaixaBank).

- If repeated failures happen, pay at a bank teller instead.

🧩 Tips for a Smooth Payment

✔ Confirm the reference number is correct before typing.

✔ Use ATMs at bank branches for fewer errors.

✔ Take photos of the receipt in case it gets lost.

✔ Don’t tear off the ticket — you might need it later.

📌 What Happens After You Pay?

Once the ATM transaction completes:

- The machine prints a receipt with your tax payment details.

- Bring this receipt to your TIE appointment at the police station.

- The police will verify the payment using the reference number.

Without this valid tax receipt, your TIE application may be rejected or delayed.

🏁 Final Summary

Paying your TIE card tax at an ATM in Spain is:

✅ Fast

✅ Safe

✅ Available 24/7

As long as you use a supported ATM, enter the correct reference number, and keep your receipt — you’ll be ready for your TIE appointment without stress.

How to replace a lost TIE-Card

How to change your green card for a TIE-Card Spain

How to renew your 5 year TIE card