If you are applying for or collecting your TIE card in Spain, one of the most confusing steps is understanding how to pay your TIE card tax correctly.

This guide explains:

- What the TIE card tax actually is

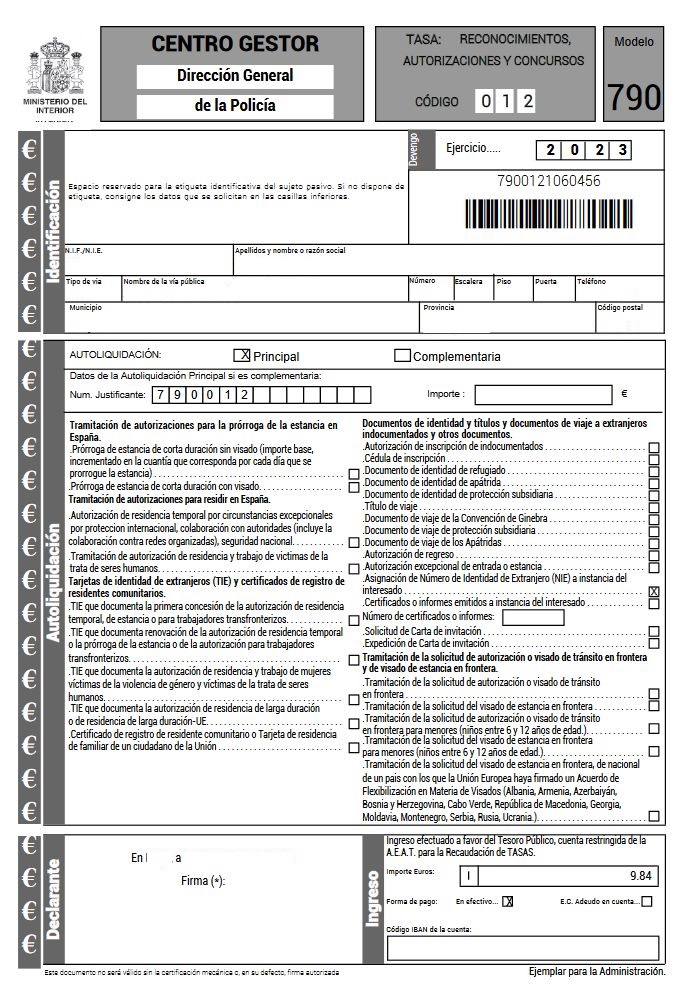

- Which form you need (Modelo 790 Código 012)

- How much you pay in 2026

- Where and how to pay it

- Common mistakes that cause appointment refusals

- FAQs based on real applicant problems

This is written to be technically accurate, legally grounded, and aligned with official Spanish immigration procedures.

What Is the TIE Card Tax?

When you apply for a Tarjeta de Identidad de Extranjero (TIE), you must pay an administrative fee to the Spanish government before your appointment at the Policía Nacional.

The TIE tax is:

- Not optional

- Not paid at the police station

- Not included in your visa approval

- Paid separately using a government tax form

The payment is made using:

Modelo 790 – Código 012

This is the official government fee form for immigration identity cards.

What Is Modelo 790 Código 012?

Modelo 790 Código 012 is the official tax form issued by the Ministerio del Interior for:

- First TIE issuance

- Renewal of TIE

- Replacement due to loss

- Replacement due to damage

- Change of personal data

- Collection of approved residence authorisations

It is downloadable online and must be completed before payment.

Official Government Source

You can access the official tax form through:

Always ensure you are using the official government portal. Avoid unofficial sites that charge extra for free forms.

Step-by-Step: How to Pay Your TIE Card Tax

Step 1: Download Modelo 790 Código 012

Search for:

“Modelo 790 Código 012 Policía Nacional”

Download the PDF form from the official government website.

Step 2: Select the Correct Fee Option

This is where many applicants make mistakes.

The form includes multiple fee options. You must tick the correct one based on your situation.

Common options include:

- TIE for first residence card issuance

- Renewal of residence card

- Replacement due to theft/loss

- Brexit withdrawal agreement card

If you tick the wrong box, your appointment may be rejected.

Step 3: Enter Your Personal Details

You must include:

- Full name (exactly as passport)

- NIE number (if already assigned)

- Passport number

- Address in Spain

- Province where appointment will take place

Double-check spelling. Any mismatch can delay your process.

Step 4: Print the Form (All Copies)

The PDF generates three copies:

- Administration copy

- Bank copy

- Interested party copy

You must print all copies before going to the bank.

Step 5: Pay the TIE Card Tax at a Spanish Bank

Take the printed form to:

- Santander

- BBVA

- CaixaBank

- Sabadell

- Or any major Spanish bank

You cannot normally pay at the police station.

The bank will:

- Stamp the form

- Keep one copy

- Return your stamped receipt

This stamped copy is what proves payment.

Read how to Pay your TIE CARD tax on the ATM Cash machine

Can You Pay the TIE Tax Online?

In some provinces, online payment is available if:

- You have a Spanish bank account

- You have a digital certificate (Certificado Digital)

- Your bank supports online tax payments

However, many applicants still pay in person because:

- Online systems can fail

- Foreign cards are sometimes rejected

- Police prefer stamped paper copies

For most first-time applicants, bank payment is the safest option.

How Much Is the TIE Card Tax in 2026?

Fees are updated annually by the Spanish government.

Typical ranges:

- First TIE card: approx €16–€20

- Renewal TIE: approx €19–€22

- Long-term residence card: slightly higher

- Replacement due to loss: similar fee

Always check the latest amount on the official government website before paying.

When Should You Pay the TIE Tax?

You must pay:

- Before your fingerprint appointment (toma de huellas)

- Bring the stamped proof of payment

- Without it, the officer can refuse your application

Payment is not required when booking your appointment — only before attending.

Common Mistakes When Paying TIE Card Tax

1️⃣ Selecting the Wrong Fee Box

This is the number one issue. Always verify the correct category.

2️⃣ Paying the Wrong Amount

Do not manually edit the amount. The form calculates automatically.

3️⃣ Forgetting to Print Before Paying

You must print the generated PDF. A screenshot is not accepted.

4️⃣ Not Bringing the Stamped Copy

Police require proof of payment.

5️⃣ Paying Too Early

If your residence authorisation has not yet been approved, wait until approval is granted before paying for fingerprints.

Special Situations

Brexit Withdrawal Agreement Applicants

If you are a UK national under the Withdrawal Agreement, ensure you select the specific Brexit-related option on the form.

Lost or Stolen TIE Card

You must:

- Report the loss (denuncia)

- Complete new Modelo 790

- Pay replacement fee

- Attend appointment

Changing Address or Data

Minor modifications may require a new fee. Always confirm before paying.

Legal Basis for the TIE Tax

The administrative fees are regulated under:

- Spanish immigration regulations (Reglamento de Extranjería)

- Ministry of Interior fee schedules

- National Police administrative processing rules

The fee covers:

- Biometric fingerprint capture

- Card production

- Identity verification

- Secure document issuance

What Happens If You Don’t Pay the TIE Tax?

Your appointment can be:

- Rejected

- Cancelled

- Delayed

You may need to book a new appointment — which in some provinces can take weeks or months.

TIE Card Tax FAQs (2026)

Do I need to pay the TIE tax if my visa was approved?

Yes. Visa approval and TIE issuance are separate processes.

Can I pay the TIE tax at the police station?

No. It must be paid at a bank (or online if eligible).

What form do I need to pay the TIE card tax?

Modelo 790 Código 012.

Can someone else pay the tax for me?

Yes. Anyone can take the printed form to the bank and pay it.

What if I paid the wrong fee?

You may need to:

- Pay again correctly

- Request a refund (long administrative process)

Do children pay the TIE card tax?

Yes, if they are issued a TIE card.

Do I need to pay the tax again for renewal?

Yes. Every renewal requires a new Modelo 790 payment.

Is the TIE tax refundable if I miss my appointment?

No. The payment is tied to administrative processing, not the appointment slot.

Can I pay with cash?

Most banks allow cash payment. Some require you to be a client.

How long is the payment receipt valid?

It is generally valid for the related application. Avoid paying months in advance.

Final Expert Advice

Paying your TIE card tax may seem like a small step, but it is one of the most common reasons appointments fail.

Always:

✔ Use official government websites

✔ Select the correct category

✔ Pay before your appointment

✔ Bring stamped proof

✔ Double-check your personal data

Getting this step right ensures your TIE application moves smoothly and without unnecessary stress.

How to replace a lost TIE CARD

Main guide to getting a TIE card in Spain 2026

Renewing your TIE Card after 5 years